How Much is Your Home Really Worth? Here’s How to Find Out

How Much Is My House Really Worth? A Practical Guide for Homeowners

Thinking about selling your home? Whether you’re planning to upgrade, downsize, or need cash for life’s unexpected expenses, the first question is always the same: “How much is my house really worth?”

Understanding your property’s value is the foundation for making smart decisions. While you could hire a professional appraiser, their services can be costly. Fortunately, there are several effective ways to estimate your home’s worth – many of which you can do yourself.

Step 1: Gather the Facts About Your Home

Before you can compare or evaluate, you’ll need the details that shape your property’s value:

-

Number of bedrooms and bathrooms

-

Total square footage of the home and lot

-

Year built and major upgrades completed

-

Age and condition of HVAC systems, roof, and water heater

-

Special features (finished basement, garage, updated kitchen, etc.)

Think like an appraiser: create a checklist that highlights both strengths and potential drawbacks. This information will help you understand where your home stands in today’s market.

Step 2: Compare Similar Homes in Your Area

One of the most reliable ways to assess your home’s value is by looking at comparables (comps) – recently sold properties that are similar in size, style, and location.

For example, if you believe your home is worth $750,000 but similar nearby homes recently sold for $700,000, it’s a signal that your expectations may be too high. On the other hand, if your home has upgrades those properties lacked, you may be justified in asking more.

Real estate agents perform a Comparative Market Analysis (CMA) using MLS data, but you can get a good idea yourself by checking online listings, municipal records, and neighbourhood sales reports.

Step 3: Look Through a Buyer’s Eyes

Numbers tell part of the story, but emotions play a role too. Buyers often compare multiple homes before making an offer, and their perspective can reveal issues you might overlook.

Ask yourself:

-

If I were house-hunting, how would my home compare to others nearby?

-

Are there visible repairs or updates needed?

-

Does my home’s curb appeal match its asking price?

Being honest about your home’s condition will help you set realistic expectations and avoid disappointment later.

Step 4: Don’t Confuse Municipal Value with Market Value

Property assessments from the city are mainly for tax purposes, not for determining how much buyers will pay. These valuations are often outdated and don’t reflect real-time market conditions.

Still, municipal data can be useful as a reference point when compared with recent sales in your area. Just don’t rely on it as your only source of information.

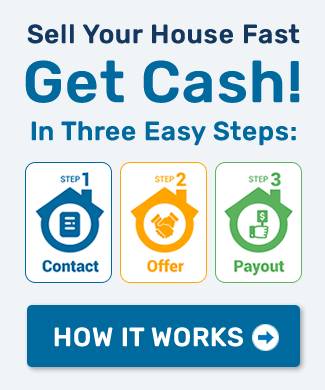

Step 5: Explore Alternatives Like Cash Home Buyers

If the idea of repairs, staging, and haggling feels overwhelming, there is another option: selling directly to a cash buyer.

At Home Flippers, we:

-

Evaluate your home’s condition and location

-

Compare it to real market trends

-

Provide a fair, no-obligation cash offer – often within 24 hours

-

Close on your timeline, sometimes in as little as a week

This option isn’t for everyone, but for homeowners who need speed, certainty, and simplicity, it can be the best solution.

FAQs About Home Valuation

1. How can I find out how much my home is worth for free?

You can use online property value estimators, check recent neighbourhood sales, and compare features to similar homes.

2. Do cash buyers pay fair market value?

Cash buyers typically offer slightly below listing price, but sellers save thousands by avoiding realtor commissions, repair costs, and carrying expenses.

3. Should I hire a professional appraiser?

If you want the most precise estimate and are willing to pay the fee, an appraisal is worthwhile. Otherwise, comps and market research are often enough.

Final Thoughts

Determining the true value of your home is not always straightforward. From gathering facts and comparing neighbourhood sales to considering buyer psychology, multiple factors influence the final price.

If you’d like to skip the uncertainty, consider speaking with Home Flippers. We’ll provide a fast, transparent, and fair cash offer – giving you clarity and peace of mind.

📞 Call us today at 647-271-3471 to learn more about selling your home quickly and stress-free.

Share This Post!

Whether you want to sell your home quickly because you are ready to retire, need to relocate, you have to pay off debt, or you simply do not want to deal with the admin that comes with real estate agents, why not consider our services? Get your FREE, No Obligation Cash Offer.

We Buy Properties (As-Is)

Fast, Easy, No Hassles!

Call or Text Us Today:

We Buy Properties (As-Is) Fast, Easy, No Hassles!

Call or Text Us Today:

(647) 271-3471

Fill Out The Form To Receive

Your Quick Cash Offer Today!

Recent Posts

Sell My House Fast In:

How Much is Your Home Really Worth? Here’s How to Find Out

How Much Is My House Really Worth? A Practical Guide for Homeowners

Thinking about selling your home? Whether you’re planning to upgrade, downsize, or need cash for life’s unexpected expenses, the first question is always the same: “How much is my house really worth?”

Understanding your property’s value is the foundation for making smart decisions. While you could hire a professional appraiser, their services can be costly. Fortunately, there are several effective ways to estimate your home’s worth – many of which you can do yourself.

Step 1: Gather the Facts About Your Home

Before you can compare or evaluate, you’ll need the details that shape your property’s value:

-

Number of bedrooms and bathrooms

-

Total square footage of the home and lot

-

Year built and major upgrades completed

-

Age and condition of HVAC systems, roof, and water heater

-

Special features (finished basement, garage, updated kitchen, etc.)

Think like an appraiser: create a checklist that highlights both strengths and potential drawbacks. This information will help you understand where your home stands in today’s market.

Step 2: Compare Similar Homes in Your Area

One of the most reliable ways to assess your home’s value is by looking at comparables (comps) – recently sold properties that are similar in size, style, and location.

For example, if you believe your home is worth $750,000 but similar nearby homes recently sold for $700,000, it’s a signal that your expectations may be too high. On the other hand, if your home has upgrades those properties lacked, you may be justified in asking more.

Real estate agents perform a Comparative Market Analysis (CMA) using MLS data, but you can get a good idea yourself by checking online listings, municipal records, and neighbourhood sales reports.

Step 3: Look Through a Buyer’s Eyes

Numbers tell part of the story, but emotions play a role too. Buyers often compare multiple homes before making an offer, and their perspective can reveal issues you might overlook.

Ask yourself:

-

If I were house-hunting, how would my home compare to others nearby?

-

Are there visible repairs or updates needed?

-

Does my home’s curb appeal match its asking price?

Being honest about your home’s condition will help you set realistic expectations and avoid disappointment later.

Step 4: Don’t Confuse Municipal Value with Market Value

Property assessments from the city are mainly for tax purposes, not for determining how much buyers will pay. These valuations are often outdated and don’t reflect real-time market conditions.

Still, municipal data can be useful as a reference point when compared with recent sales in your area. Just don’t rely on it as your only source of information.

Step 5: Explore Alternatives Like Cash Home Buyers

If the idea of repairs, staging, and haggling feels overwhelming, there is another option: selling directly to a cash buyer.

At Home Flippers, we:

-

Evaluate your home’s condition and location

-

Compare it to real market trends

-

Provide a fair, no-obligation cash offer – often within 24 hours

-

Close on your timeline, sometimes in as little as a week

This option isn’t for everyone, but for homeowners who need speed, certainty, and simplicity, it can be the best solution.

FAQs About Home Valuation

1. How can I find out how much my home is worth for free?

You can use online property value estimators, check recent neighbourhood sales, and compare features to similar homes.

2. Do cash buyers pay fair market value?

Cash buyers typically offer slightly below listing price, but sellers save thousands by avoiding realtor commissions, repair costs, and carrying expenses.

3. Should I hire a professional appraiser?

If you want the most precise estimate and are willing to pay the fee, an appraisal is worthwhile. Otherwise, comps and market research are often enough.

Final Thoughts

Determining the true value of your home is not always straightforward. From gathering facts and comparing neighbourhood sales to considering buyer psychology, multiple factors influence the final price.

If you’d like to skip the uncertainty, consider speaking with Home Flippers. We’ll provide a fast, transparent, and fair cash offer – giving you clarity and peace of mind.

📞 Call us today at 647-271-3471 to learn more about selling your home quickly and stress-free.

Share This Post!

Whether you want to sell your home quickly because you are ready to retire, need to relocate, you have to pay off debt, or you simply do not want to deal with the admin that comes with real estate agents, why not consider our services? Get your FREE, No Obligation Cash Offer.

We Buy Properties (As-Is)

Fast, Easy, No Hassles!

Call or Text Us Today:

We Buy Properties (As-Is) Fast, Easy, No Hassles!

Call or Text Us Today:

(647) 271-3471

Fill Out The Form To Receive

Your Quick Cash Offer Today!

Why Choose Cash House Buyer over realtor?

Working with Home Flippers has some distinct advantages over selling through a real estate agent. We are not real estate agents; we are investors who buy houses for cash fast.

Some of the benefits of working with us are:

- Fast closings. We can often close in as little as seven days because our purchase does not depend on approved financing, home inspections, or appraised values.

- Selling “as is.” We buy homes in any condition, so you won’t have to worry about costly repairs or upgrades that would typically be required.

- No need to move before selling. Your house won’t need to be “kept “show ready” for months while you live somewhere else, shouldering the cost of monthly payments.

- Avoid contingency clauses. House contracts are notorious for “back out” clauses that protect buyers but not sellers. With Home Flippers, you won’t have to worry about the sale falling through at the last minute.