Complete Guide to Stopping and Avoiding Foreclosure in Ontario

Facing the risk of losing your home can feel overwhelming, isolating, and frightening. Many Ontario homeowners believe that once foreclosure begins, there is no way out. The truth is that in most cases, it is still possible to stop foreclosure in Ontario if you understand the process early and act quickly. Even in 2025, with higher interest rates, tighter lending rules, and increased household debt across Canada, homeowners still have options.

This educational guide explains how foreclosure works in Ontario, how it differs from power of sale, what pre-foreclosure means, and what real solutions exist to avoid losing your home. Most importantly, it explains how selling your house, including to a private cash buyer, can help protect your equity and give you a fresh financial start.

Understanding Foreclosure and Related Terms in Ontario

Many homeowners use the word foreclosure to describe any situation where a lender takes control of a property. In Ontario, the process is more specific, and understanding the terminology can help you make better decisions.

Foreclosure in Ontario

Foreclosure is a legal process where the lender takes full ownership of the property. Once foreclosure is completed, the homeowner loses all rights to the property and any remaining equity.

In Ontario, foreclosure is less common than power of sale. Lenders typically pursue foreclosure only when the property has little or no equity or when selling it would not recover the outstanding debt.

Key points:

-

The lender becomes the owner of the home

-

The homeowner loses any equity

-

The process goes through the courts

-

Credit damage is severe and long-lasting

Power of Sale

Power of sale is the most common enforcement method used by lenders in Ontario. Instead of taking ownership, the lender sells the property to recover the mortgage debt.

Under power of sale:

-

The homeowner still owns the property until it is sold

-

Any remaining equity after the sale belongs to the homeowner

-

The lender must follow strict notice timelines

-

The property is often sold below market value

Power of sale moves quickly, especially in 2024 and 2025, as lenders are acting faster due to market uncertainty and higher carrying costs.

Pre-Foreclosure

Pre-foreclosure is the period before a lender starts legal enforcement. This is usually when:

-

Mortgage payments are missed

-

Notices of default are sent

-

The lender warns of power of sale or foreclosure

This is often the best time to act. Many solutions are still available during pre-foreclosure, including selling the property, refinancing, or negotiating with the lender.

Short Sale

A short sale occurs when a property is sold for less than the amount owed on the mortgage, with the lender’s approval.

In Ontario, short sales are less common than in the United States but still possible in certain situations, especially when:

-

Property values have dropped

-

The mortgage balance is higher than the home’s value

-

The lender agrees that selling is better than enforcing

Short sales are complex and time-consuming, and lenders are not required to approve them.

Why Foreclosure Risk Has Increased in Ontario in 2025

Ontario’s real estate market has changed significantly since 2020.

Key factors affecting homeowners today:

-

Mortgage renewals at much higher interest rates than previous terms

-

Increased property taxes, utilities, and insurance costs

-

Slower home price growth in many Ontario cities

-

Tighter lending rules for refinancing

-

Rising household debt and cost of living pressures

Many homeowners are not irresponsible or careless. They are simply facing financial conditions that changed faster than expected.

How to Stop or Avoid Foreclosure in Ontario

The right solution depends on your situation, timeline, and equity position. Here are the most common paths.

1. Talk to Your Lender Early

Lenders prefer solutions over enforcement. If you are still in pre-foreclosure, you may be able to:

-

Request a temporary payment deferral

-

Adjust your payment schedule

-

Extend the amortization period

This works best if your income disruption is temporary.

2. Refinance or Consolidate Debt

If you still have sufficient equity and qualifying income, refinancing may help by:

-

Lowering monthly payments

-

Consolidating high-interest debt

-

Catching up on arrears

However, in 2025 many homeowners no longer qualify due to stress-test rules and higher rates.

3. Sell the Property Before Enforcement

Selling before power of sale or foreclosure allows you to:

-

Protect your credit as much as possible

-

Control the timeline

-

Preserve equity

-

Avoid legal fees and penalties

This option is often overlooked because homeowners feel emotionally stuck. Selling does not mean failure. In many cases, it is the most responsible financial decision.

4. Selling to a Private Cash Home Buyer

In some situations, traditional selling is not realistic. This is where a private cash home buyer can help.

A private buyer can be a solution when:

-

Time is limited

-

The property needs repairs

-

Showings and listings are not possible

-

Tenants are in place

-

The lender has already issued power of sale notices

How a House Cash Buyer Can Help Stop Foreclosure in Ontario

In urgent situations, working with a cash house buyer can be a practical and effective solution.

A reputable cash buyer can:

-

Buy the property as-is

-

Close in days or weeks, not months

-

Cover legal and closing costs

-

Eliminate showings and repairs

-

Work directly with your lawyer and lender

This option is often ideal when:

-

The property needs repairs

-

Tenants are in place

-

Time is extremely limited

-

Banks keep declining refinancing

-

Stress and uncertainty are taking a toll

While a cash offer may be lower than a perfect market sale, it often results in more money in your pocket than foreclosure or forced sale.

Selling Your Home Is Not the End. It Can Be a New Beginning

One of the biggest misconceptions about foreclosure is that losing a home defines your future. It does not.

Many people who sell under financial pressure go on to:

-

Rebuild credit

-

Rent temporarily while stabilizing finances

-

Purchase again in the future

-

Regain peace of mind and stability

The key is acting before enforcement removes your choices.

When Should You Seek Immediate Help?

You should seek professional guidance immediately if:

-

You have received a notice of sale or default

-

Mortgage arrears are increasing

-

Renewal payments are no longer affordable

-

Legal letters from the lender have arrived

-

You feel overwhelmed and unsure what to do next

Waiting too long often removes the best solutions.

Final Thoughts: There Is Still Hope

If you are facing foreclosure or power of sale in Ontario, you are not alone. Thousands of homeowners are navigating the same uncertainty in today’s market. What matters most is knowing that solutions exist, even when it feels like there are none.

Education, early action, and exploring all available options can protect your future. Whether that means negotiating with your lender, selling traditionally, or working with a private cash buyer, the goal is the same: regaining control and moving toward a more stable life.

If you would like clarity on your situation, call us at 647-271-3471 to speak with us directly. We will explain your options in plain language and without pressure. Sometimes, one simple conversation can change everything.

Share This Post!

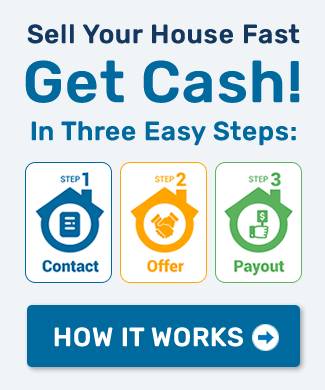

Whether you want to sell your home quickly because you are ready to retire, need to relocate, you have to pay off debt, or you simply do not want to deal with the admin that comes with real estate agents, why not consider our services? Get your FREE, No Obligation Cash Offer.

We Buy Properties (As-Is)

Fast, Easy, No Hassles!

Call or Text Us Today:

We Buy Properties (As-Is) Fast, Easy, No Hassles!

Call or Text Us Today:

(647) 271-3471

Fill Out The Form To Receive

Your Quick Cash Offer Today!

Recent Posts

Sell My House Fast In:

Complete Guide to Stopping and Avoiding Foreclosure in Ontario

Facing the risk of losing your home can feel overwhelming, isolating, and frightening. Many Ontario homeowners believe that once foreclosure begins, there is no way out. The truth is that in most cases, it is still possible to stop foreclosure in Ontario if you understand the process early and act quickly. Even in 2025, with higher interest rates, tighter lending rules, and increased household debt across Canada, homeowners still have options.

This educational guide explains how foreclosure works in Ontario, how it differs from power of sale, what pre-foreclosure means, and what real solutions exist to avoid losing your home. Most importantly, it explains how selling your house, including to a private cash buyer, can help protect your equity and give you a fresh financial start.

Understanding Foreclosure and Related Terms in Ontario

Many homeowners use the word foreclosure to describe any situation where a lender takes control of a property. In Ontario, the process is more specific, and understanding the terminology can help you make better decisions.

Foreclosure in Ontario

Foreclosure is a legal process where the lender takes full ownership of the property. Once foreclosure is completed, the homeowner loses all rights to the property and any remaining equity.

In Ontario, foreclosure is less common than power of sale. Lenders typically pursue foreclosure only when the property has little or no equity or when selling it would not recover the outstanding debt.

Key points:

-

The lender becomes the owner of the home

-

The homeowner loses any equity

-

The process goes through the courts

-

Credit damage is severe and long-lasting

Power of Sale

Power of sale is the most common enforcement method used by lenders in Ontario. Instead of taking ownership, the lender sells the property to recover the mortgage debt.

Under power of sale:

-

The homeowner still owns the property until it is sold

-

Any remaining equity after the sale belongs to the homeowner

-

The lender must follow strict notice timelines

-

The property is often sold below market value

Power of sale moves quickly, especially in 2024 and 2025, as lenders are acting faster due to market uncertainty and higher carrying costs.

Pre-Foreclosure

Pre-foreclosure is the period before a lender starts legal enforcement. This is usually when:

-

Mortgage payments are missed

-

Notices of default are sent

-

The lender warns of power of sale or foreclosure

This is often the best time to act. Many solutions are still available during pre-foreclosure, including selling the property, refinancing, or negotiating with the lender.

Short Sale

A short sale occurs when a property is sold for less than the amount owed on the mortgage, with the lender’s approval.

In Ontario, short sales are less common than in the United States but still possible in certain situations, especially when:

-

Property values have dropped

-

The mortgage balance is higher than the home’s value

-

The lender agrees that selling is better than enforcing

Short sales are complex and time-consuming, and lenders are not required to approve them.

Why Foreclosure Risk Has Increased in Ontario in 2025

Ontario’s real estate market has changed significantly since 2020.

Key factors affecting homeowners today:

-

Mortgage renewals at much higher interest rates than previous terms

-

Increased property taxes, utilities, and insurance costs

-

Slower home price growth in many Ontario cities

-

Tighter lending rules for refinancing

-

Rising household debt and cost of living pressures

Many homeowners are not irresponsible or careless. They are simply facing financial conditions that changed faster than expected.

How to Stop or Avoid Foreclosure in Ontario

The right solution depends on your situation, timeline, and equity position. Here are the most common paths.

1. Talk to Your Lender Early

Lenders prefer solutions over enforcement. If you are still in pre-foreclosure, you may be able to:

-

Request a temporary payment deferral

-

Adjust your payment schedule

-

Extend the amortization period

This works best if your income disruption is temporary.

2. Refinance or Consolidate Debt

If you still have sufficient equity and qualifying income, refinancing may help by:

-

Lowering monthly payments

-

Consolidating high-interest debt

-

Catching up on arrears

However, in 2025 many homeowners no longer qualify due to stress-test rules and higher rates.

3. Sell the Property Before Enforcement

Selling before power of sale or foreclosure allows you to:

-

Protect your credit as much as possible

-

Control the timeline

-

Preserve equity

-

Avoid legal fees and penalties

This option is often overlooked because homeowners feel emotionally stuck. Selling does not mean failure. In many cases, it is the most responsible financial decision.

4. Selling to a Private Cash Home Buyer

In some situations, traditional selling is not realistic. This is where a private cash home buyer can help.

A private buyer can be a solution when:

-

Time is limited

-

The property needs repairs

-

Showings and listings are not possible

-

Tenants are in place

-

The lender has already issued power of sale notices

How a House Cash Buyer Can Help Stop Foreclosure in Ontario

In urgent situations, working with a cash house buyer can be a practical and effective solution.

A reputable cash buyer can:

-

Buy the property as-is

-

Close in days or weeks, not months

-

Cover legal and closing costs

-

Eliminate showings and repairs

-

Work directly with your lawyer and lender

This option is often ideal when:

-

The property needs repairs

-

Tenants are in place

-

Time is extremely limited

-

Banks keep declining refinancing

-

Stress and uncertainty are taking a toll

While a cash offer may be lower than a perfect market sale, it often results in more money in your pocket than foreclosure or forced sale.

Selling Your Home Is Not the End. It Can Be a New Beginning

One of the biggest misconceptions about foreclosure is that losing a home defines your future. It does not.

Many people who sell under financial pressure go on to:

-

Rebuild credit

-

Rent temporarily while stabilizing finances

-

Purchase again in the future

-

Regain peace of mind and stability

The key is acting before enforcement removes your choices.

When Should You Seek Immediate Help?

You should seek professional guidance immediately if:

-

You have received a notice of sale or default

-

Mortgage arrears are increasing

-

Renewal payments are no longer affordable

-

Legal letters from the lender have arrived

-

You feel overwhelmed and unsure what to do next

Waiting too long often removes the best solutions.

Final Thoughts: There Is Still Hope

If you are facing foreclosure or power of sale in Ontario, you are not alone. Thousands of homeowners are navigating the same uncertainty in today’s market. What matters most is knowing that solutions exist, even when it feels like there are none.

Education, early action, and exploring all available options can protect your future. Whether that means negotiating with your lender, selling traditionally, or working with a private cash buyer, the goal is the same: regaining control and moving toward a more stable life.

If you would like clarity on your situation, call us at 647-271-3471 to speak with us directly. We will explain your options in plain language and without pressure. Sometimes, one simple conversation can change everything.

Share This Post!

Whether you want to sell your home quickly because you are ready to retire, need to relocate, you have to pay off debt, or you simply do not want to deal with the admin that comes with real estate agents, why not consider our services? Get your FREE, No Obligation Cash Offer.

We Buy Properties (As-Is)

Fast, Easy, No Hassles!

Call or Text Us Today:

We Buy Properties (As-Is) Fast, Easy, No Hassles!

Call or Text Us Today:

(647) 271-3471

Fill Out The Form To Receive

Your Quick Cash Offer Today!

Why Choose Cash House Buyer over realtor?

Working with Home Flippers has some distinct advantages over selling through a real estate agent. We are not real estate agents; we are investors who buy houses for cash fast.

Some of the benefits of working with us are:

- Fast closings. We can often close in as little as seven days because our purchase does not depend on approved financing, home inspections, or appraised values.

- Selling “as is.” We buy homes in any condition, so you won’t have to worry about costly repairs or upgrades that would typically be required.

- No need to move before selling. Your house won’t need to be “kept “show ready” for months while you live somewhere else, shouldering the cost of monthly payments.

- Avoid contingency clauses. House contracts are notorious for “back out” clauses that protect buyers but not sellers. With Home Flippers, you won’t have to worry about the sale falling through at the last minute.